Market Volatility Increases, Short Term Shift to Risk Aversion

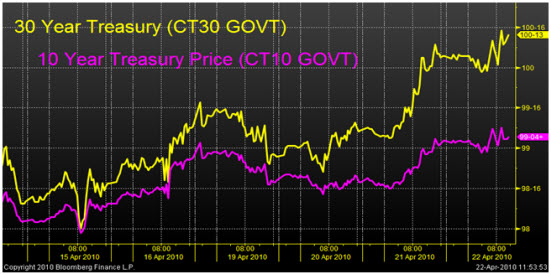

This week volatility came back to the markets after what had seemed to be a parabolic move upwards in the major equity indices over the past few months. Many traders are describing the situation as the inevitable occurrence they were all waiting for, at least in the near term. This is due to the fact that even strong up trends need to have periods of consolidation or correction; in fact, corrections are a necessary factor for market technicians to consider the trend valid. Nonetheless, this week proved to be a flight to safety as the US dollar gained strength and Treasury yields decreased on the 10 and 30 year bonds as government debt rallied. Following last week’s market breaking news of the SEC filling fraud charges against banking giant Goldman Sachs, the negative bias continued as traders sold into positive earnings announcements. Across the board this week, the majority of earnings announcements came out positive (beating analyst estimates), this is optimistic news for the market, yet instead of prices going higher, stocks were sold off. This could be occurring for a number of reasons. On a micro level, investors and speculators could believe that the stock prices already reflect the good earnings that were released, and therefore have no reason to go up. On a macro global level, the sell off could have to do with sovereign debt issues in Europe, a problem that has been of major concern for some time now as Moody’s continued to cut Greece’s credit rating on Thursday.

This wave of good and bad news cause the market to swing in a range bound manner over the week, making for a tough market on both the long and short side. Although this market action may not be the most favorable in the near term, many believers do not think that this is a time to panic, rather a pause in the major uptrend that should expectedly continue in the extended term. Option traders are also finding encouragement in this market, as this environment tends to be beneficial. They can begin to collect a more favorable return for their risk, in the form of credit type spreads and other option positions. This is the result of option premiums increasing due to higher implied volatility in the market, which can be seen in the VIX (Volatility Index) that spiked up to the 19 point level this week.

-A. Tarhini

Economic Update

Initial and Continuing Jobless Claims

Continuing Jobless claims have increased slightly from 4.639 million to 4.646 million since the last survey. Initial Claims have decreased from 484 thousand to 456 thousand for the week of April 17th. The overall trend for both is still downward sloping.

Michigan Consumer Confidence

Consumer Confidence as reported by the University of Michigan came in lower than expected at 69.5. The previous survey had indicated an index level of 73.6. This index is widely believed to be an indication of what the Consumer Confidence number from the Conference Board will look like.

Housing Starts and Existing Home Sales

Housing starts saw an uptick as the number of projects shot up from 575 thousand to 626 thousand. Existing Home sales rose for the period of March from February by 6.8%. Both these numbers are indicative of a strengthening real estate market.

Goldman Sachs, Barrack Obama and Wall Street

On April 16th the Securities Exchange Commission brought charges against Goldman Sachs; Claiming that the company had defrauded investors. The SEC argues that Goldman allowed hedge fund manager John Paulson to select the components to put in a CDO in which he subsequently bet against. Shares of Goldman tumbled almost 14% after the announcement was made. The firm released a statement which said

“The SEC’s charges are completely unfounded in law and fact and we will vigorously contest them and defend the firm and its reputation”

Many managers on Wall Street believe the SEC has overstepped its authority. They argue that there are always two sides to a trade and that Goldman is not required by law to disclose the name of the institution betting on the opposite outcome. They argue that large well capitalized institutions were the ones on the opposite side and had large research departments who advised to take long positions in the CDO. Goldman spokesperson said that the law suit is unfounded seeing as how Goldman also lost 90 million by taking a long position in the CDO. The conflict at Goldman has sparked outrage at Wall Street.

On April 22, Barrack Obama appeared in New York City and endorsed the new regulatory reform bill being drafted in Congress. He argued that the financial crisis “was born of a failure of responsibility – from Wall Street to Washington” and urged the American people to stand behind the push for regulatory reform. Critics argue that the subprime market was created by government intervention in the free market and that the use of Freddie and Fannie Mac were the sole culprits of the financial crisis.

–R. Belsky

European Ash War and its Economic Impacts

The name ‘Eyjafjallajokull’ itself sounds enormous, not to mention the worldwide aftermath of its eruption during the six day period last week. This volcano eruption has sent shock waves beginning in Iceland, the European continent and eventually across the globe due to the swath of economic fallout it resulted in.

The airline industry was the first to suffer – with around 102,000 flights being cancelled due to the dense ash plumes emitted in the atmosphere, there has been an estimated loss of $1.7 billion in revenue for the entire industry. It may hence, take approximately three years for the sector to recover from the lost flying time last week. Almost $400 million in revenue was lost per day during the first three days of the volcanic eruption leading to cancelled and grounded flights in the European continent.

This event comes in an untimely manner when the businesses worldwide are just recovering from a deep recession. Therefore, analysts worldwide are looking for ways for the airlines to be compensated for the revenues they lost. It seems that governments should be summoned to aid carriers recover this cost due to the fact that the airline industry has been suffering for a while, with losses of $9.4 billion last year and an expected loss of $2.8 billion more this year which will be deepened even more after this crisis.

The shares of major European carriers saw a declining trend during the close of last week with BA (-3.42%), Lufthansa (-2.75%), KLM AirFrance (-2.95%) and Ryanair (-3.12%); even though their credit speculations have not been affected.

The eruption resulted in a worldwide impact which has caused travel mayhem and spurred an inefficiency of adherence between the global suppliers and their customers in the various realms of the global export-import markets. However, while the airline sector fared negatively, other industries have taken advantage of the situation and expanded at the expense of air travel.

–R. Zacharia

Article submitted by: Alex Tarhini, Robert Belsky and Rowena Zacharia of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.