U.S. Economic Data

Amidst the troubles in Europe, oil spill off of the U.S. coast, insider trading, and an overall volatile market; this week’s market action seemed fairly calm. At one point in the week rumors began to float about China possibly conducting a major selling operation of European debt. Around the same time China publicly denied this, news of BP possibly stopping the oil spill also leaked, along with some uplifting economic data.

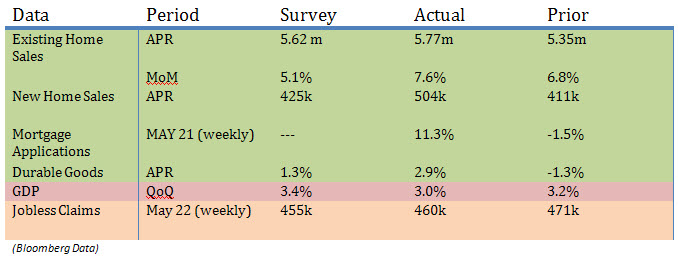

For the month of April existing home sales rose 7.6% MoM (month over month), indicating that U.S. buyers maybe entering the market once again. At the same time, new home sales rose for the month by 93k homes (see table above). In line with other real estate data, mortgage applications rose by 11.3% for the week, much better than the 1.3% decrease last week. Durable goods for the month also came in better than expected, indicating a rise in production. The only negative data was GDP for the quarter, coming in at 3.0%, a decrease from 3.2% and less than the expected 3.4%.

–Alex Tarhini

Euro Currency Issues Continue

Throughout the week, investors and traders alike continued to sell the European currency. As of Thursday, the Euro had netted a 212 pip decline for the week. Investors began to sell the Euro at the end of 2009 and since then it has fallen 2769 pips relative to the dollar. The debt crisis in Europe has casted doubt upon whether or not the Euro currency can remain sound. Earlier this month, the European Central Bank agreed on providing 750 billion Euros for crisis relief. Initially the markets responded by rallying 337 pips but continued downward a few days later.

Jim Rogers, CEO of Rogers Holdings, commented on the package:

“This is a signal to me that they are giving up on the Euro, they don’t care whether the Euro is a sound currency or not. They are saying to the member states: spend the money somebody will bail you out; run up big debts don’t worry everything will be ok. As far as I’m concerned, it’s more corrosion of the Euro from within.”

It seems reasonable to agree with Mr. Rogers. In order to provide the funds for the package, The European Central Bank will have to print and debase the European currency. Members of the Eurozone will have access to the funds and will be able to borrow from the ECB to relieve the burden caused by high interest expenses on their debt. This system, while meant to promote market confidence, seems to have fallen short. The debt issues have not been resolved. Allowing countries in the Eurozone to borrow further may relieve market pressures in the short run, but the implications are worrisome for long run European growth.

Many economists in the last few weeks have argued about the merits of the package and the viability of the “European experiment”. However, the reality is that the market is telling its own story. The price of the Euro has dropped more than 12% since the onset of the crisis and almost 4% since the announcement of the “rescue package”. Investors are not very confident about the stability of the currency and believe that the package will have little or no effect on the underlying debt issues present in Portugal, Greece and Spain. Mohammed El-Erain, Top fund manager at Pimco, said in an interview for Barron’s magazine:

“If the issues for the peripheral European countries aren’t resolved, it’s a bigger problem for Europe-wide issues, including the euro. Next, you ask the question of what happens to the euro zone itself. What happens to the euro zone should be taken seriously as a risk scenario. This is about 10 steps away from what the market is willing to recognize.”

If the underlying debt issue is not resolved, the euro may continue on its tumble downwards.

–Robert Belsky

Australian Gains

Last week, expectations rose, after the Australian newspaper reported the probability of the government’s decision to alter the rate at which the mining profit tax would kick in which would be 11or 12 percent instead of the 6 percent that was announced on May 2, 2010. Earlier in May, the government had proposed a 40 percent tax on mining profits beginning in the year 2012 that would result in estimated revenue of Australian $12 billion during the course of the first 2 years.

Hence, shares of Melbourne based BHP Billiton Ltd., which is the largest mining company in the world, mounted up 1.5 percent to Australian $37.83 as of 10:00A.M(local time) on May 27th. Furthermore, shares of London based Rio Tinto Group also rose 1.3 percent to Australian $64.81 on this positive news.

Moreover, BHP Billiton Ltd. along with 12 other coal-mining companies such as Rio Tinto group, Xstrata Plc, Peabody Energy Corp, etc have bid for the Australia’s largest railroad for Australian $4.85 billion which surpassed the government’s expectations. These companies thus, seek to get control over these tracks, which would aid in their expansion of coal transport in these times of high demand worldwide, and subsequently decrease the transportation costs considerably.

Another positive trend seen last week was the rise in the shares of Foster’s Group Ltd., which is the biggest maker of liquor in Australia, when it announced the demerger of its wine and beer units. This is the first major rise in Foster’s shares in almost four years with an advancement of 7.4 percent to Australian $5.53. This was because the wine unit, which includes brands such as Wolf Blass and Beringer was not profitable and hence brought down the company as a whole. Furthermore, they believe that the beer unit, which is very solid and has a market value of Australian $12.5 billion on its own, could be focused upon more so that it would lead to better earnings and profit margins in the near future.

– Rowena Zacharia

Article submitted by: Alex Tarhini, Robert Belsky and Rowena Zacharia of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab please visit https://business.fiu.edu/capital-markets-lab/.