US Economic Data

This week the market saw the release of numerous US economic indicators. On Tuesday, August 31st the consumer confidence level was released, at 53.5 versus the consensus median of 51.0. Some believe this increase in confidence is in line with Ben Bernanke’s view that he exuded in his speech last week; which was the idea that the economic recovery would pick up strength in 2011. However, although the number was better than expected, the details were not so great. The report showed that consumers were less hopeful about the jobs market going forward, which emphasizes the important issue that the Fed has been attempting to combat for some time now. It also showed that home buying plans were minimal, with only 2% of the respondents considering a home purchase in the near future.

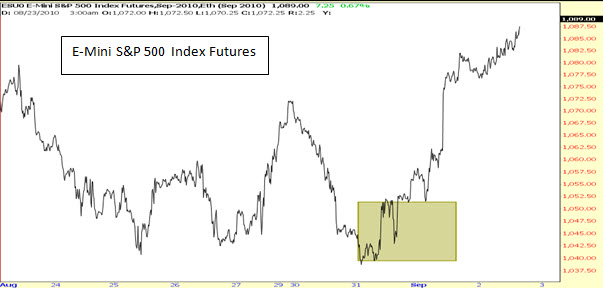

Following the consumer confidence announcement, the Chicago purchasing managers index was released at a level just near what was expected. The index for August was 56.7 versus the expect 57, down from the previous level of 62.3. Between Consumer confidence levels and Chicago PMI, the market seemed to feel mixed, making quick, sporadic moves both up and down, which can be seen in the highlighted area in the graph. However, once ISM manufacturing data was released on Wednesday, September 1st, the market rallied to the upside on better than expected data. ISM numbers came in at 56.3 versus the consensus 52.8. The market then rallied strongly until the Thursday close (this was written on Thursday, Friday data still unknown), gaining over 4.5% from the lows of Tuesday, August 31. Although some economic data was better than expected, most of it was still not very exciting news for the economy.

– Alex Tarhini

Burger King Going Private

Last week, the second largest fast food chain, Burger King Holdings Incorporated posted a very weak earnings release for fiscal year 2010. The fast food chain posted a 7% drop in earnings per share for fiscal year 2010 and a steep 16% drop in earnings for the quarter. Worldwide sales dipped 2.3%, while sales in North America demonstrated a larger drop of 3.9%. McDonald’s Corporation released earnings earlier this month that showed sales an increase in earnings of 15% coupled with a 4.8% increase in comparable sales. Burger King cited weakness in the global economy as a reason for their frail performance; however, McDonald’s, a company that chases the same market share, outperformed Burger King greatly.

In response to comparatively weak performance, this week there were rumors that Burger King was in negotiations to be bought out by a private equity firm. Volume surged 26 times the previous day’s volume as investors rushed to take advantage of any premium that could potentially be offered for Burger King’s shares. On 9/10/2010 as a result of the buyout, Burger King Holdings issued a press release that shareholders would receive $24.00 per share in cash, a 46% premium pre-rumor price. The acquiring firm is 3G Capital which is a value investing firm that focuses on companies that have highly predictable economics that allow them to make highly accurate predictions of their intrinsic value. The buyout allows Burger King Holdings 40 days to solicit a better deal but, as of yet, no other offers have been made to take the fast food company private.

– Michael Alfaro

Rig Explosion

On Thursday the Vermillion Oil Rig 398, a rig that is 80 miles off the coast of Louisiana reported a fire at a production platform. According to the US Coast Guard, there was an explosion and as a result 12 workers ended up in the water. However, no news has been reported as to whether or not the explosion caused any fatalities. This explosion comes after the BP oil rig explosion, which caused a large scandal and ultimately led to a moratorium on offshore drilling. While the details of this explosion have not fully been revealed, it is sure to stir up issues just recently removed from the public’s focus; namely, the role and importance of offshore drilling. Mariner Energy Inc., a publicly traded company on the NYSE, is the owner of the rig and it has yet to comment as to how deep the damage will be. The BP oil disaster caused BP’s stock to drop drastically by 55% in value in a short time span of only two months. ME traded from $23.50 to $19.62 intraday as news arrived of the explosion. There has still been no word as to whether or not there is any leak associated with the explosion. If there is any environmental impact, Mariner Energy’s stock price will surely suffer because of hefty cleanup expenditures and higher political risk.

– Robert Belsky

Article submitted by: Michael Alfaro, Robert Belsky and Alex Tarhini of the Capital Markets Lab. To learn more about the Capital Markets Lab please visit their web site https://business.fiu.edu/capital-markets-lab/. View all articles by Capital Markets Lab.