Obama’s New Budget

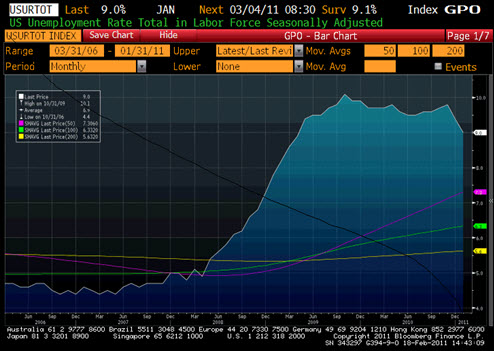

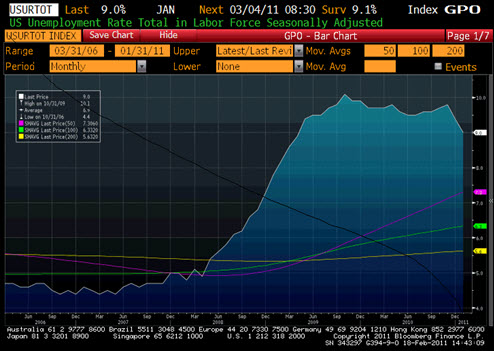

The road to recovery out of the recent recession has been tough and filled with mixed feelings on the future. Many initiatives have come to fruition since the credit crunch of 2008. Financial regulation with the Dodd-Frank Act, troops being existed from the Middle East, and increased pressure from United States citizens to make do more with less have all been central topics since the new administration took power. With unemployment still hovering over 9%, many critics argue that our current recovery is not sustainable. A primary target of this issue is government spending. As President Obama took office in 2008, he gathered plans to put America on a competitive edge to the world economy while leading the road to recovery. The president used many different vehicles but one common characteristic was large amounts of government spending. The president and his administration employed government spending as a way to kick start our economy, spur growth of jobs and lead to prosperity as this country once experienced. However, despite all the efforts by the fiscal authority, the United States is still experiencing above normal levels of unemployment.

This past Monday, the president released the United States government budget for 2012. Surprising most, the budget appeared to cut less spending then first anticipated. Standing at a total of $3.73 trillion, many reviews have shown disappointment with the President’s choices. Many Republicans see the matter in a different light. They feel that the way to get people back to work is through less government spending and less regulation. Many critics with this argument view tax cuts for business and individuals as key drivers to success. Believing that our private sector will provide the tools necessary to get the United States economy producing, spending and consuming, the new budget goes directly against the former view. The deficit has reached historic highs and it’s believed that many cuts in spending from the government will be needed to take control of it. Damian Paletta from the Wall Street Journal recently wrote; “The new budget does propose some great initiatives such as $46 million dollar increase in spending for EPA and $584 million to support research and innovation into emerging environmental sciences”. Programs such as these keep the primary goal in driving progress and efficiency. Even though many critics could disagree with the constituents of the new proposal, only time will tell how it will impact our workforce and job creation. Although many businesses have returned to profitably, consumer spending also returning to attractive levels, the true growth will come from large increases in productions and services. That level of growth can all be fulfilled with lower levels of unemployment.

– Andre Villareal

NYSE Euronext Shareholders Sue Over Takeover

Shareholders of NYSE Euronext are not satisfied with the terms of the consolidation agreement with German exchange Deutsche Boerse. In a recent lawsuit filed in Delaware, the compensation for the sale is called “grossly inadequate” and charges that the Board of Directors of NYSE Euronext did not act in the best interest of shareholders, breached fiduciary duty and violated state laws by approving the transaction. The fact that the deal did not emerge from an auction process and that Deutsche Boerse was given an exclusive opportunity to bid for the company is at the center of the disagreement. A separate lawsuit filed in New York alleges that the sale “offers no meaningful premium to NYSE’s public shareholders.” A major issue is that the valuation of NYSE determined for the merger is being called into question. Bloomberg reports, “The transaction values NYSE Euronext at 8.3 times earnings before interest, taxes, depreciation and amortization. That compares with 9.35 times EBITDA for TMX and 18.35 for ASX Ltd., the Australian stock- market operator being acquired by Singapore Exchange Ltd.”

The consolidation of the two exchanges was announced on Tuesday, February 15 and marks the second time they have attempted to merge. The first attempt, in 2008, fell apart after a German newspaper leaked the talks before the companies had been able to finalize key aspects of the deal. Under the terms of the current consolidation, a new holding company, called Alpha Beta Netherlands Holding NV has been created. NYSE Euronext shareholders will be receiving 40% and Deutsche Boerse shareholders will be receiving 60% of the newly created company. The CEOs of each company settled on the creation of a Dutch entity in an effort to ease criticism that either company was selling out to a foreign competitor. The final name of the joint exchange has yet to be determined but the total value is being reported at $9.5 billion.

– Chris Jones

Currency Trades for the Week

On Friday, the Euro rose from 1.3544 to 1.3686 amid hawkish comments from the European Central Bank. Lorenzo Bini Smaghi, an ECB board member, expressed the ECB’s concern for risk of inflation. Such risk stems from the increased pace of Europe’s economic recovery as well as rising commodity prices, which affects price growth. Given the upward trend in EUR/USD during intra-day trading, trader sentiment expects a near term rate hike by the ECB.

The Sterling reached a weekly high of 1.6235 amid U.K.’s retail spending report, which rose 1.6% in January. The Bank of England will release its policy meeting minutes on Feb. 23. The BofE’s previous comments have heightened trader expectations of a future rate hike. Traders will be looking for hawkish comments from the BofE’s Feb. 23rd minutes to justify bullish positions on GBP/USD.

This week the market saw positive U.S. economic data, particularly optimism on U.S. manufacturing. However, Middle East turmoil has overshadowed such positive data, sending the USD/CHF towards a steady bearish trend. Reports of Iranian warships en route to the Suez Canal leading up to a possible confrontation between Iran and Israel over the oil-transporting waters have caused investors to seek a safe haven in the Swiss franc. Switzerland’s reputation of having a neutral foreign policy and staying out of conflicts with other powers, give investors comfort in a time of turmoil. This week the USD/CHF fell from its second 2011 peak of .9775 to .9450.

– Shaun Hoyes

China’s Yuan Expansion

Throughout history, humanity has seen a major player dominate the wide spectrum of culture, politics, and of course on economic power. Some examples include: in ancient times we had the Egyptians, Babylonians and Greeks; in the modern era we have had Venice, Amsterdam, England, and eventually the United States since the early 20th century until the present. Economists are starting to consider China as the next super power of the world, and now China is beginning to take steps towards the supplanting its reserves of US dollars and eventually floating the Renminbi.

Analysts believe that China’s Renminbi will eventually replace the dollar as the primary currency for international transactions. Enticed by a low labor cost, close to double digit growth rate, and a giant market; companies have started look at China to establish operations. Companies like McDonald’s and Caterpillar have recently issued yuan denominated bonds in Hong Kong to finance their operations in mainland. These types of bonds have been especially attractive to investors who are looking to take advantage of the short supply of yuan-related investment opportunities and an eventual currency appreciation of the remnibi.

According to Aaron Back from The Wall Street Journal, last years’ foreign direct investment in China was $75.5 billion. On Thursday, Government officials announced that they will allow Yuan foreign-exchange options to be traded domestically, a measure that aims to provide firms with the ability to enjoy more hedging flexibility, and reduce their currency risk.

– Wellington Rodriguez

Sources

- Sabet, Badi. International Banking. Miami: Florida International University, 2008

- The Wall Street Journal

Article submitted by: Andre Villareal, Chris Jones, Shaun Hoyes and Wellington Rodriguez of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.