Gold Market: Losing Shine?

After falling below $1,521 an ounce, gold prices have officially entered a bear market. Three historical price ranges are in focus. The range $1,487 to $1,548 an ounce is where gold surged higher in 3Q 2011, and prices are already below these levels. Other potential ranges where prices could stabilize are $1,313 to $1,421 an ounce and $1,237 to $1,256. Gold consolidated in these ranges for a time before moving higher.

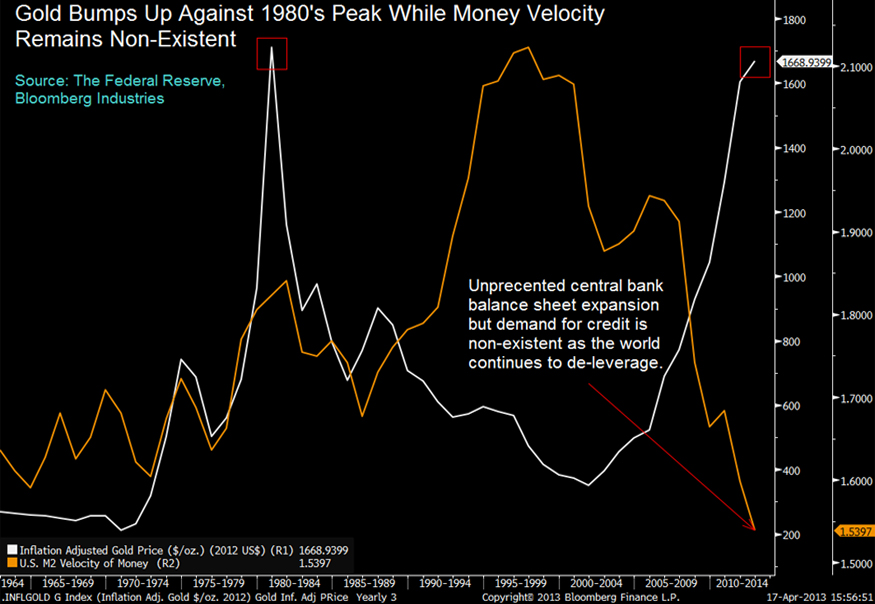

Aside from severe price consolidation, inflation has not surpassed expectations and has pushed the Federal Reserve to expand its balance sheet. This situation has caused real rates to rise and has built a greater case for the price downturn in gold as stronger equity markets suppress inflation worries. Deleveraging economies has overshadowed the previously mentioned Fed balance sheet expansion. At the end of 2012, gold reached its highest inflation-adjusted level since 1980. It has since then fallen from that peak and entered into a strong bear market.

– Nicolas Lopez

Article submitted by: Nicolas Lopez of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.