Weekly Information Center

Market Insight

Federal Reserve officials began discussion on ways to exit or slow down the asset purchase program in 2014, leading the markets to gain short-term ground following the release of the FOMC meeting minutes.

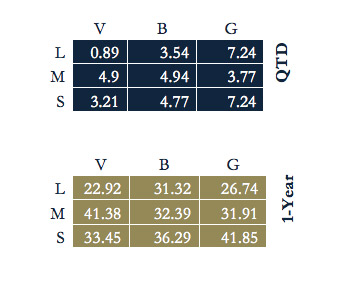

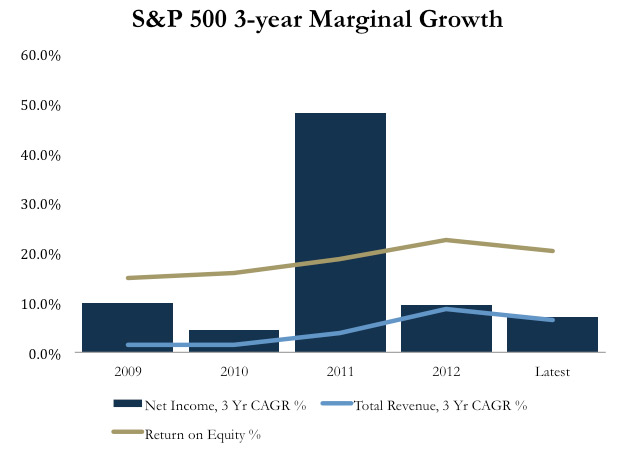

Despite the potential scale back of the quantitative easing program, the Federal Reserve emphasized that it will maintain short-term interests near zero and not “taper” until unemployment levels reach 6.5% and inflation 1.5%. However, consumer prices index reported a decrease of -.1% to 1% year-over-year. With the unemployment level at 7.3% and inflation stagnant at 1%, “tapering” of the bond-buying program may not begin until mid to late 2014. As a result, it is imperative for investors to be well-positioned for an eventual hike in long-term rates. Although economic reports were not as robust as expected, 95.4% of S&P 500 companies having disclosed earnings for the season reported an increase in operating earnings of 12.2% year-over-year indicating another consecutive record level for the S&P 500. In turn, the low inflation and interest rates make stocks, particularly large-cap and growth stocks, appear cheap in relative terms.

Weekly Review

- CPI decreased 100 bps to .1%

- The producer price index fell .2

- Existing home sales decreased from 5.29m in the previous month to 5.12m

- Initial claims decreased from 344k to 323K

- Retail sales increased to .4%

What to look for next Week

- Housing Starts

- Pending Home sales

- Consumer Confidence

- Durable orders

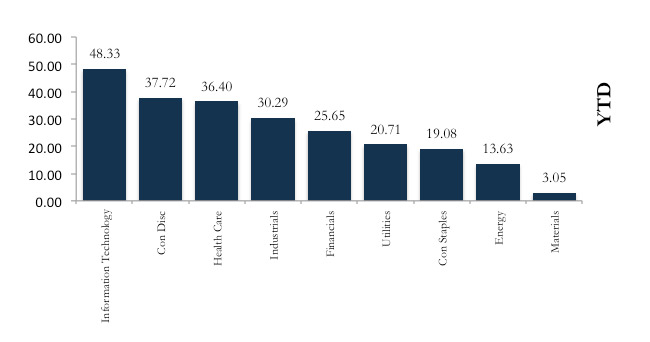

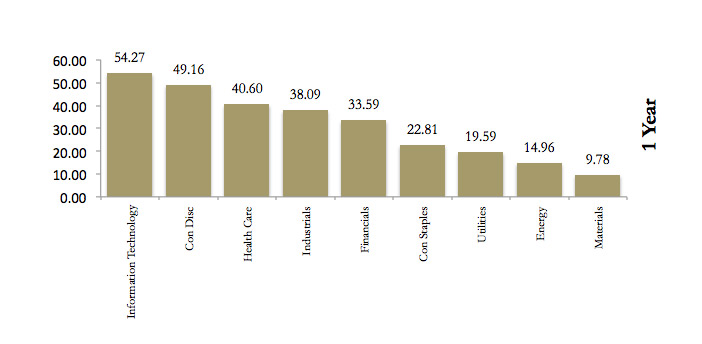

S&P 500 Sector Performance

Style Returns

Chart of the Week

Article submitted by: J. Camilo Parra of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.