During economic downturns, investors often flock to the consumer staples sector because consumer staples is mainly comprised of companies that sell nondurable goods, goods that do not last longer than three years. These products, which are necessities, have inelastic demand because when the economy is in a recession, consumers have lower disposable income; this steers consumers away from buying durable or luxury goods (i.e. washing machines, automobiles, televisions, etc.) and forces them to focus on necessities (i.e. food, beverages, cosmetics, and cleaning supplies). This is why consumer staples is a safe haven for investors during tough economic times; consumers are always going to purchase products such as toilet paper, toothpaste, and pampers, no matter what kind of economic disparity they might be dealing with.

The consumer staples sector is comprised of mainly blue chips companies in their mature growth phase, which dominate their subsectors in an oligopolistic fashion. We can find examples of this in the beverage industry, such as Pepsi and Coca Cola. These two beverage giants own most of the market share and follow one another’s lead if the other successful (i.e. Coca Cola’s Coke Zero made a huge splash and Pepsi soon followed suit with their own zero-calorie soft drink: Pepsi Max).

Threats within the consumer staples sector are substitute goods like generic brands. Supermarkets are supplying their own brand names in which the quality is remarkably close to those of industry leaders. Due to “The Great Recession”, people have been forced to try these generic products and have somewhat shifted way from top brand names. These consumers may even become complacent and continue to use generic brands even if the economy heads towards an upswing.

The consumer staples sector is not known for having high-yielding growth (i.e. Apple Inc. in 2011) but for industry giants that constantly manufacture common staple products that the average consumer needs, and are more known for their reliable high-dividend yields. This is why the consumer staple stock is a great way to protect your portfolio: such stocks are the suppliers of necessities.

Consumer staples was the best performing sector in 2011, and our portfolio had two positions called (Kimberly Clark (KMB) and Church & Dwight (CHD)), leaving only one remaining position (Proctor & Gamble (PG)). The consumer staples team decided to keep Proctor & Gamble because of their 3.1% dividend yield and their growth potential. The consumer staples team applauds previous management of this sector for purchasing shares of Proctor & Gamble when the company was going through a rough patch in 2009-2010 and lost markets share. However, since then Proctor & Gamble management has recaptured decent market share through marketing efforts, buy backs, and a showing of strong confidence in their business.

The Spring 2012 Consumer Staples group is headed by sector manger Justin Garcia, and analysts Erick Saize, Ryan Brewer, and Felipe Fernandez.

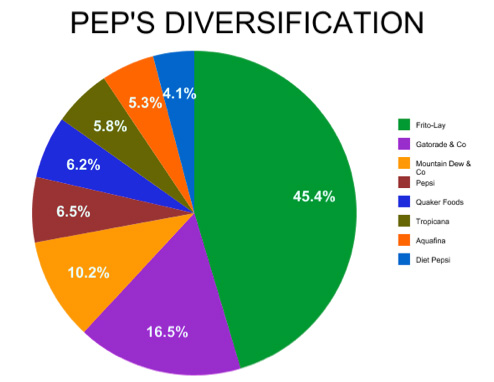

With the approval of the finance board, the consumer staples team purchased Pepsi Co. (PEP), which was presented by Erick Saize. The reason for the purchase was because of Pepsi’s diverse portfolio in not only in the beverage market with Pepsi and Gatorade, but in the snack market with products like Frito-lays, and Doritos.

With the approval of the finance board, the consumer staples team purchased Pepsi Co. (PEP), which was presented by Erick Saize. The reason for the purchase was because of Pepsi’s diverse portfolio in not only in the beverage market with Pepsi and Gatorade, but in the snack market with products like Frito-lays, and Doritos.

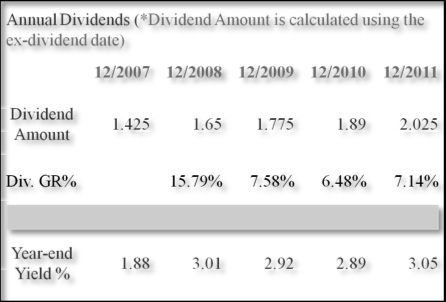

Pepsi Co. also had recent partnerships and acquisitions that will give them exposure to the BRIC nations with the transparency of GAAP regulations. There was the purchase of “Mabel”, a Brazilian cookie manufacturer, and a recent partnership with Tingyi-Asahi Beverage Holding Co. Ltd. (TAB), the largest bottling company in China. Another attractive aspect of Pepsi Co. is their constant dividend growth rate of 7%, amounting to a 3.1% dividend yield.

The next purchase was Sysco (SYY), presented by Ryan Brewer. The reason for the purchase was Sysco is an industry leader in the food transportation business; they dominate the market with 180 distribution facilities across the U.S. and Canada that cannot be matched by competitors. They also have a sustainability program in which they work hand-in-hand with growers and ranchers, making sure the quality of their produce and meats are superior to government standards. They also use Enterprise Resource Planning software, which is an integrated system that mirrors Walmart’s supply support system, allowing an easy streamline to support customers when their supplies are low. SYY also had an attractive dividend yield of 3.5%, even through the rough economic periods of 2008, 2009, and 2010 where SYY disbursed a dividend of 1.83, 1.77, and 1.99 respectively. The consumer staples team is also hoping for the rise of economic prosperity. With recent jobless claims trending downward, we are hoping the average consumer will have more disposable income to spend in restaurants, which is SYY’s main customer base (62%).

There is an inverse correlation between the SYY stock price (green line) and U.S. Jobless claims (red line). In 2009, jobless claims hit a high and SYY was at its lowest point; this coincides with 2003-2008 jobless claims at a low and SYY being high. It looks like jobless claims figures are trending towards 2003-2008 levels, and the consumer staples team is hoping SYY will follow suit. If this scenario does not come to fruition, there is the constant increase in dividend payments (blue line) to fall back on.