Sequester Overview

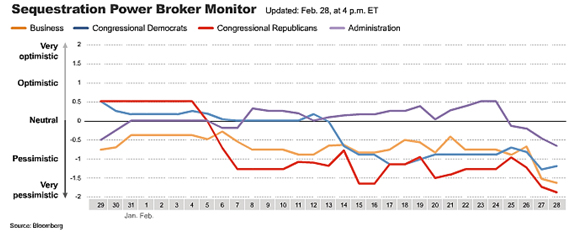

Congressional stalemates are no unfamiliarity to the U.S. bureaucratic environment. This time around congress has the federal government contemplating the fiscal future of our accounts. On the eve of the Sequester, the federal government approaches the March 1st deadline to execute $85.3 billion across-the-board. There are three plans to avoid so-called sequestration though a vast difference between Republicans and Democrats makes a solution uncertain. The Democratic plan would raise taxes on millionaires and makes cuts to defense and farm programs. Republicans have said they won’t agree to a deal that includes new taxes or defense cuts.

The highlight of the sequester focuses primarily on cuts to Medicare Part D, which assists older U.S. citizens with their prescription drug costs. It is proposed to only be 5% of the total $11 billion in proposed cuts to Medicare. The Part D cuts will have the greatest month-to-month fluctuations, the highest coming in August, based on Bloomberg Government analysis. When considered on a quarterly basis, 4Q13 may have the lowest impact, with all others in-line.