Weekly Information Center

Market Insight

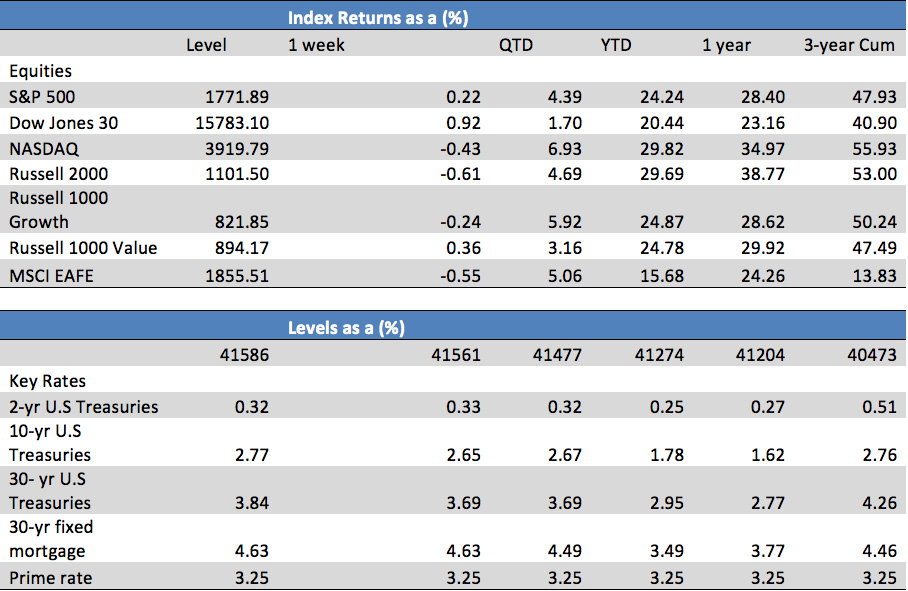

The market has shown continuing underlying economic fundamentals, with the Bureau of Labor Statistics reporting an increase in private payrolls of 204,000 from a previous 150,000. The private employment sector signals to a bettering labor market, which coupled with a .3% advance in Q3 GDP to 2.8%, could provide further signals of a steady developing economy. In addition, the S&P 500 and the Dow Jones Industrial Average have experienced the strongest quarters since 2003, with quarter gains of 4.39% and 1.70% respectively. Despite the decrease in labor force in October due to the government shutdown, long-term labor force has depicted a developing trend. Furthermore, the economic progress has driven the equity market to achieve a strong performance for the year.

Weekly Review

- Factory orders inched up higher for September 1.7%, but decreased 10 basis points for the month of August

- ISM services index increased 4 bps to 55.4

- Real GDP growth advanced 2.8% in Q3 from 2.5% in Q2, beating estimates by 30 bps

- Unemployment rate grew 10 bps to 7.3% from 7.2%

What to look for next Week

- Trade Balance

- Treasury Budget

- Wholesale Inventories

- Industrial Production

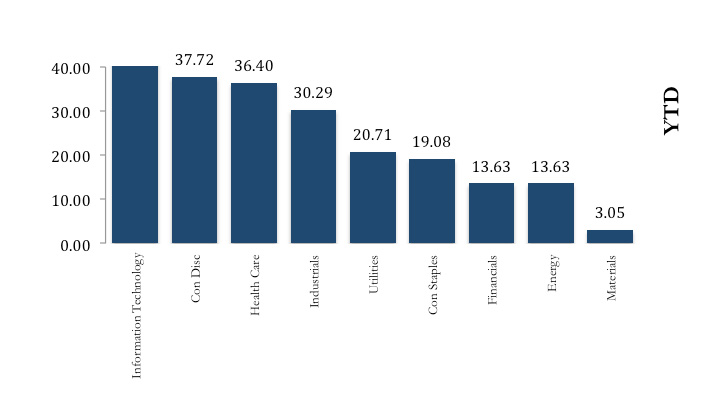

Sector Performance

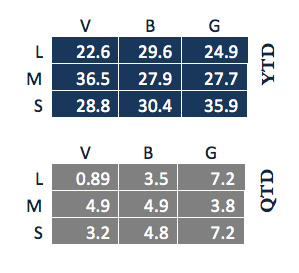

Style Returns

Article submitted by: J. Camilo Parra of the Capital Markets Lab. To learn more about the Capital Markets Lab please visit their web site https://business.fiu.edu/capital-markets-lab/.