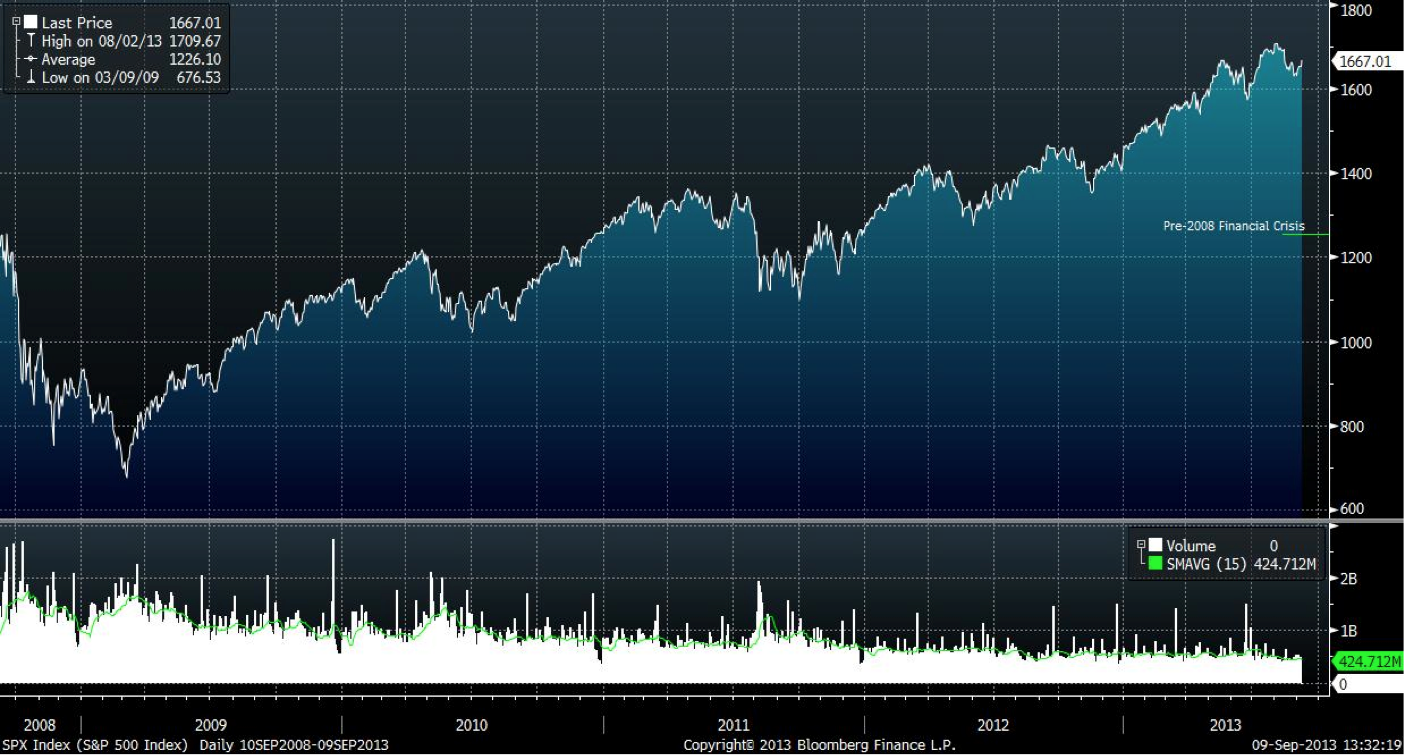

U.S stocks continue on a steady rally as the S&P extends gains into a fifth session, following exceeding export forecasts from China. The bond market also rallies as treasury yields fall from two year highs, amid the Fed’s update on its bond-buying program next week.

The Dow Jones Industrial average .DJI was up 121.27 points, or .81% at 15,043.77 at midday. The Standard & Poor’s 500 Index .SPX was up 12.36 points, or .74% at 1,667.47. The NASDAQ Composite was up 34.00 points, or .93% at 3,693.92.

After an upbeat market opening and news of Apple’s .AAPL +1.76% new iPhone models, the technology sector took the lead with an increase of 1.21%, followed closely by the energy sector at 608.92 up by 5.71 points, or .94%. Likewise, the market rallied through the midday with financials at 267.85, up 1.65 points, or .62%; consumer staples and discretionary at 409.62 and 466.83, up .34% and .68% respectively; and the health care sector at 580.42, up 87 points or .14%.

While markets have advanced and extended gains in the month of September, the low volume, high volatility, and historically difficult month for stocks in August is likely to pick up toward the end of the year as President Barack Obama is expected to nominate a replacement for Federal Reserve Chairman, Ben Bernanke.

Despite the continuance of the Fed’s tapering of the 85-billion dollar bond-buying program, the benchmark 10 year yields have fallen 97 basis points from two year highs of 3% to 2.903%. Friday’s employment report showed a softer performance compared to forecasts for August, while actual added jobs in June and July were revised downward. The Fed is expected to announce its cut when policymakers meet next week.

Wall Street finished higher for the week on Friday as reports indicate a recovering U.S and global economy, amid concerns of possible U.S military action in Syria and the Fed’s policies on monetary stimulus.

Article submitted by: By J. Camilo Parra of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.