Weekly Information Center

Market Insight

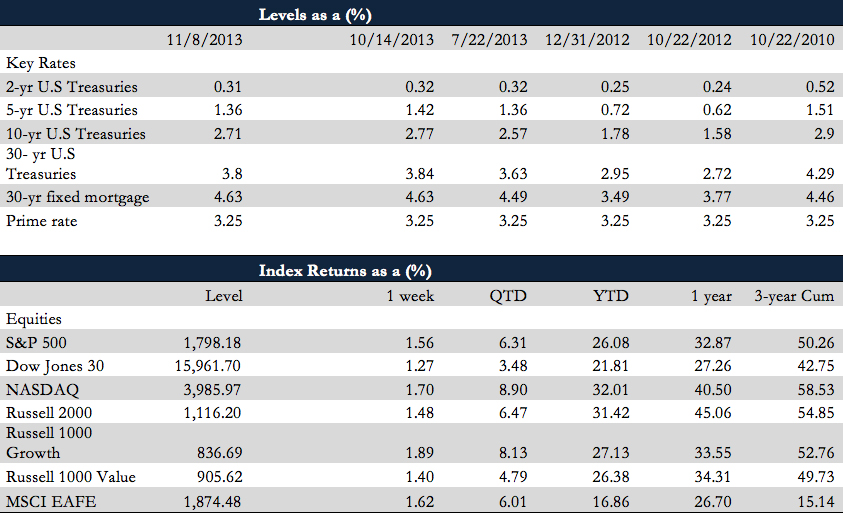

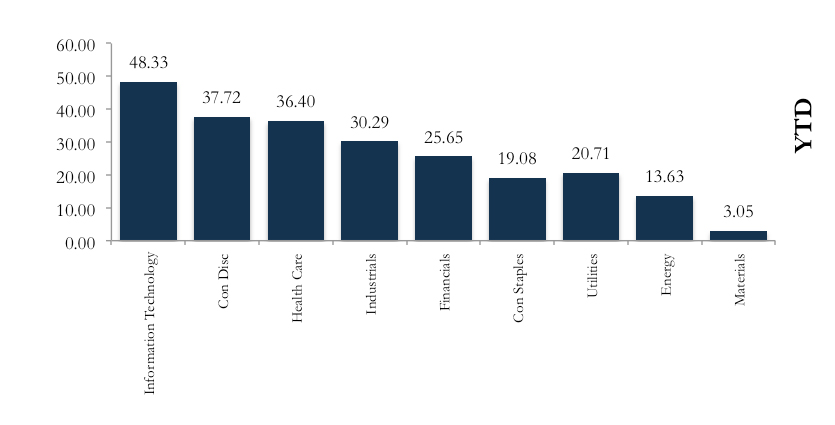

The Dow Jones Industrial Average and the S&P 500 hit new highs on Friday, marking a sixth consecutive week of gains ending on 15,961.70 and 1,798.18 respectively. Furthermore, the S&P 500 Information Technology sector has shown robust growth, with returns of 48.33% year-to-date and 54.27% year-over-year. Additionally, the strong rally in U.S equities suggests a strong investor sentiment, which will remain high if the Federal Reserve decides to delay its asset-purchase policy. The economy showed improvement in unemployment, with initial claims decreasing to 339,000. However, the economic indicators for the week point to lower than expected readings, which may have been offset by the government shutdown earlier this quarter.

Weekly Review

- Initial jobless claims decreased from 341K to 339K

- Productivity and costs index for Q3 increased to 1.9%, from previous reading of 1.8% in the prior quarter

- Industrial production decreased by .1% from .7% in Q2

- Wholesale inventories increased modestly by .4%

- The treasury budget decreased by-$91 billion, leading the trade balance deficit to expand to -$41.8 billion

What to look for next Week

- CPI

- Retail sales

- Existing home sales

- Leading Indicators

- Federal Reserve quantitative easing

Sector Performance

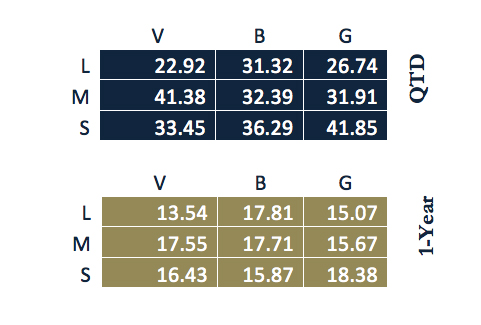

Style Returns

Article submitted by: J. Camilo Parra of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.