Industry Performance – Investment Banking

Goldman Sachs’ 15.7% return led global investment bank stocks in 1Q, followed by Morgan Stanley (15.2%). Both companies have shown a cost control commitment, and the revenue outlook has improved with markets. The two have among the highest capital markets earnings exposure. Nomura’s 14.7% return closely follows, with continued Japanese monetary support. European Deutsche Bank’s stock (down 7.4%) was the worst performer in the quarter. The Bloomberg Industries Global Investment Banks Index returned 6.3% in 1Q, underperforming the MSCI World Financial Index (7.6%) and broader MSCI World Index (7.9%). Investment bank stocks (13.5%) had been outperforming financials (10.2%) and the broader market (8.5%) through mid-March.

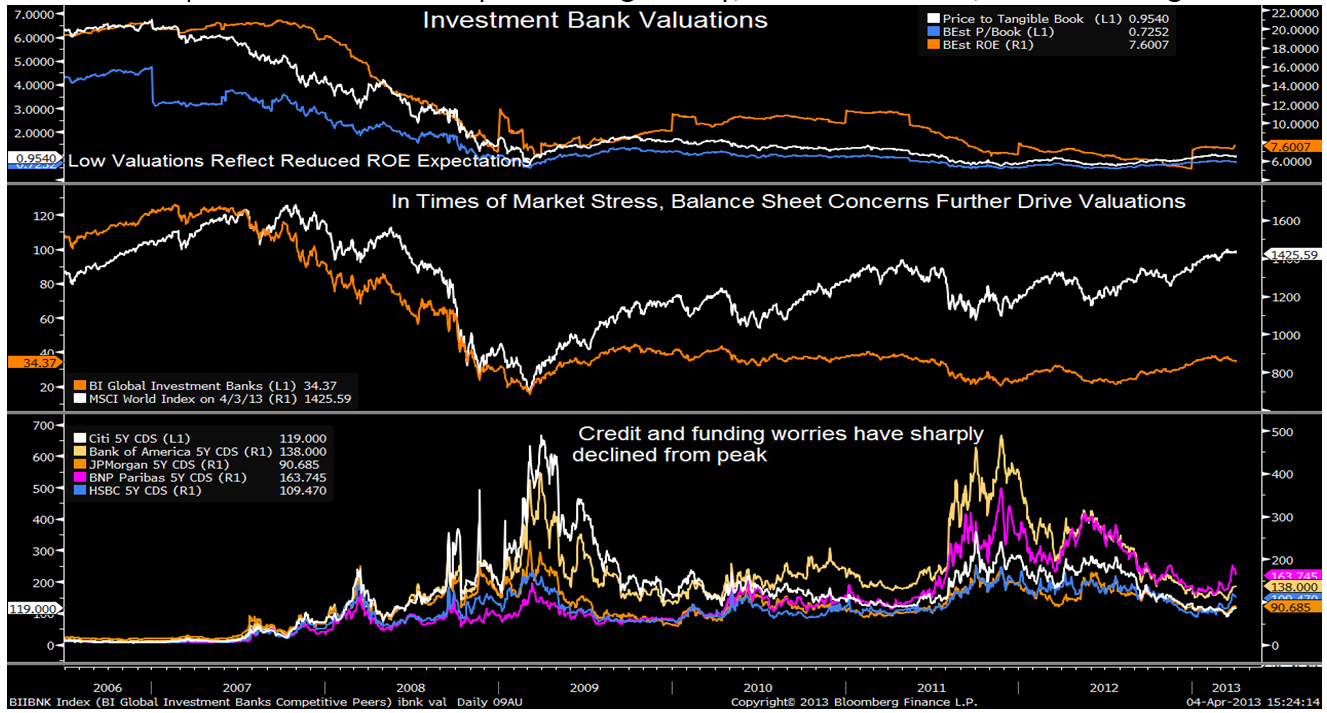

Sovereign debt concerns and market volatility are key drivers of bank credit valuations during the past couple of years. Declining risk has helped drive down risk premiums since mid-2012, as global monetary support has broadly improved credit markets and reduced near-term balance sheet risk. Prices reached an inflection point in mid-March as the Cyprus crisis has revived sovereign debt and geopolitical concerns. Investment bank valuation multiples are higher in 2013, extending 2012’s gain as credit and liquidity indicators have improved with global monetary support. While market indicators and cost control have bolstered the near-term earnings outlook, valuations remain at historically low levels, reflecting long-term profit concerns and persistent uncertainty about regulatory, macroeconomic, fiscal and litigation risks.

– Nicolas Lopez

Sources: Bloomberg Industries

Article submitted by: Nicolas Lopez of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.