Weekly Information Center

Market Insight

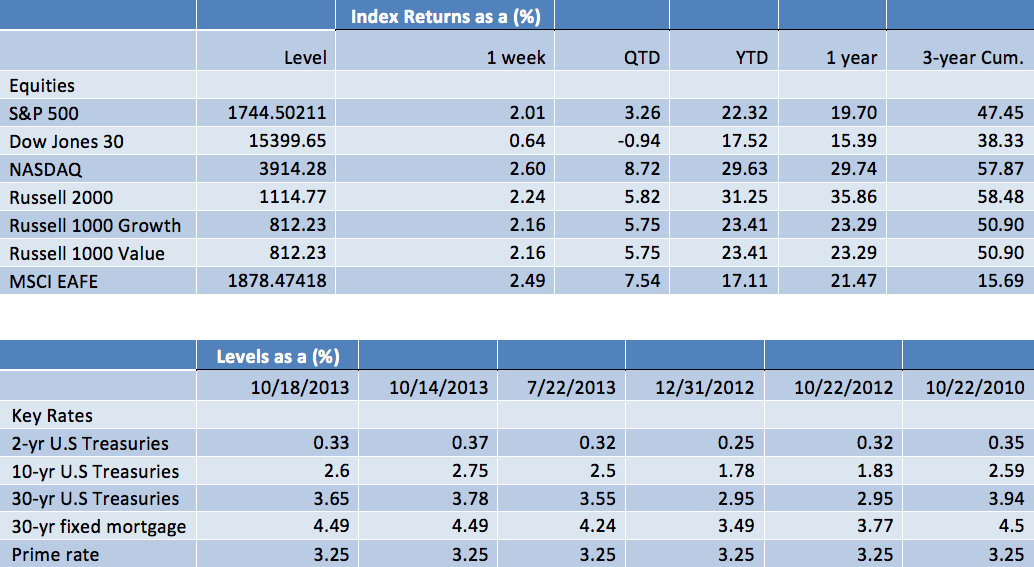

Markets rallied sharply following the deal to reopen the government and extend the debt-ceiling, leading the S&P 500 to set a new all-time high. The 16-day shutdown; however, has delayed the release of several economic indicators, which will be reported in the coming weeks. Nevertheless, current data suggests that the stalemate in Washington has affected consumer confidence surveys, which could signal to a lower consumer spending reading in October. Approximately 21% of S&P companies have reported their earnings so far for the season with 61.5% topping expectations, above from the historical moving average. Although it may be an early indicator, the current earnings readings could signal to yet another strong quarter for large cap equities. Beyond the stalemate in Washington, long-term economic trends such as rising household consumption, a recovering unemployment rate, diminishing fiscal drag, and high corporate profits should continue to drive U.S economic growth

Weekly Review

- The U.S government reopened and extended the debt ceiling after the 16-day shutdown.

- Following the reopening of the U.S government, the S&P 500 capped its biggest weekly gain in three months reaching a new all-time high.

- Although the earnings season has just begun, it has yielded mixed results, with revenue growth as a primary concern. Profits; however, have illustrated robust growth and large cap companies have topped expectations.

- With 21% of S&P companies having released earnings, 61.5% have topped expectations, a slightly higher reading than historical average. Additionally, 52% have topped revenue, below the historical average of 61%

What to look for next Week

- Existing Home Sales

- Employment report for September

- Consumer Sentiment

- Private Payrolls

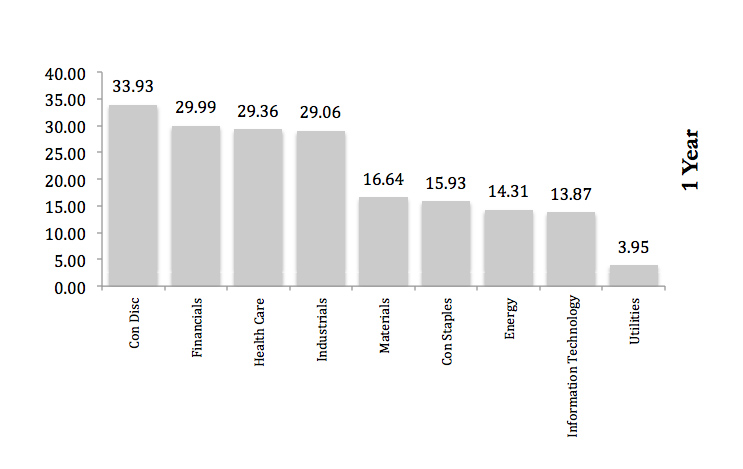

Sector Performance

Article submitted by: J. Camilo Parra of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.